Kanzu Banking and Stanbic Bank have joined forces to digitize SACCOs throughout the country. After a rigorous procurement process, Stanbic Bank selected Kanzu Code as one of the Fintechs to digitize its SACCOs. The move aims to provide secure financial records and improve operational efficiency by bringing bank-grade software to the unbanked and underbanked.

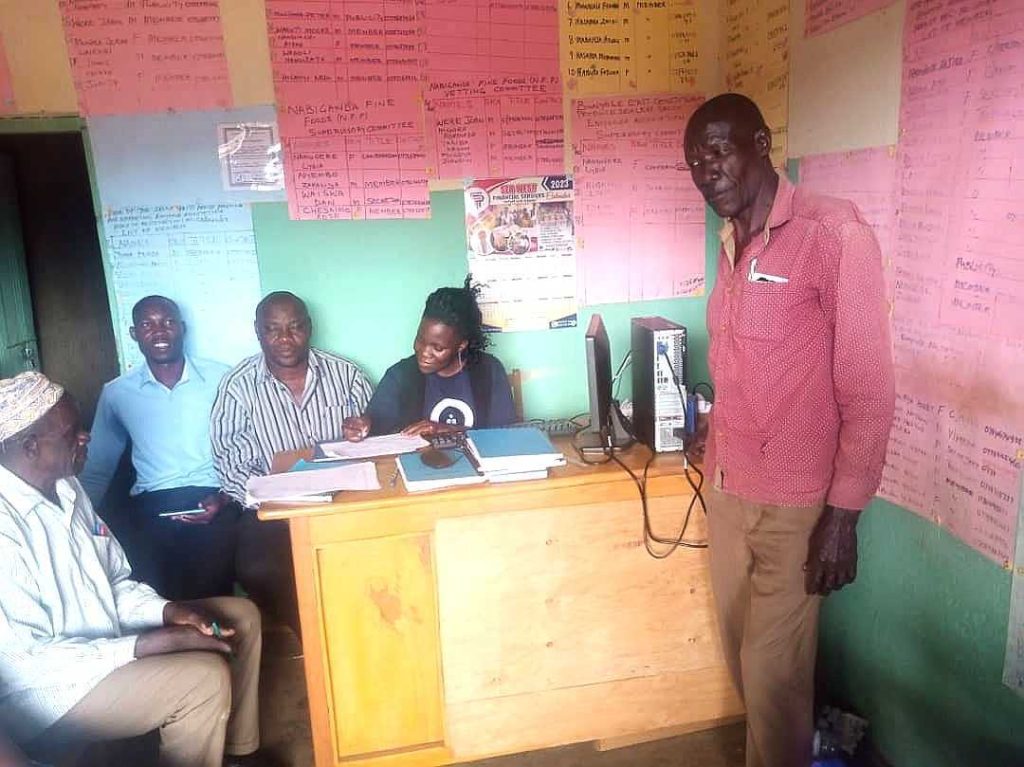

The digitization process is now in its fourth phase. In the first three phases, Kanzu Code travelled around the country to educate SACCOs on the impact of digitization, visited SACCOs that had been approved by Stanbic Bank to be digitized, conducted feasibility tests to ascertain the SACCOs’ network requirements, computer literacy, access to electricity, and consent from the committee and members for the change. Lastly, data migration from manual paper records to Kanzu Banking involved intensive training for both members and administrators of the SACCOs on how to utilize the system entirely. This is to help the SACCO members run the system independently, leading to Kanzu Code stepping back and offering maintenance services plus guidance when needed.

The digitization process has had a significant impact on the SACCOs.

- It has made it easier for their management to have real-time oversight of operations. Reports can now be generated in real-time and causes of any inconsistencies are easily tracked.

- SACCOs with operations in multiple branches can now easily exchange information thanks to cloud-based software solutions.

- Digitization has improved loan repayment rates by 29% to 40%. Before digitisation, it was difficult for SACCOs to track loan repayments, resulting in delays and missed repayments.

- The cost of stationery has been reduced by 70% to 80%. SACCOs that relied on a paper-based system experienced significant cost savings.

- The time spent performing daily tasks has been reduced by 2 to 4 hours, and the time it takes for a member to make a deposit has been reduced by 70% to 90%.

- Digitization has reduced the time it takes to process loan payments by 60% to 80%. Finally, digitization has increased the earning potential of SACCOs, with revenues growing by 4% beyond the organic growth rate.

The benefits of digitization go beyond improving operational efficiency. Digitization has increased the level of trust that members have in SACCOs. Previously, members found it hard to trust that their money was safe with manual systems. With digitization, members can now track their transactions in real-time, which has increased their level of trust in SACCOs. Digitization has also made it possible to integrate with platforms like mobile money. This innovation has enabled SACCOs to offer new services to their members, which has resulted in continued growth and continuity.

In conclusion, the partnership between Kanzu Banking and Stanbic Bank has revolutionized SACCOs. Digitization has brought bank-grade software to the unbanked and underbanked, providing them with secure financial records and improving operational efficiency.

I love the fact that you are uplifting SACCOs with technology because they are institutions tailored towards reducing poverty and vulnerability among urban communities and ultimately supporting socio-economic transformation in Uganda. Kudos!!